-

「沖縄ベイ・ブルース」歌詞の意味|宇崎竜&阿木燿子のメッセージとは

「沖縄ベイ・ブルース」の歌詞の意味やメッセージについて知りたい。「失恋ソングなのに、なぜ沖縄の社会問題と関係があるの?」「歌詞に込められた深い意味を知りたい!」 そんな疑問を解決する記事です。 「沖縄ベイ・ブルース」は、宇崎竜童さんと阿木... -

木綿のハンカチーフ歌詞ひどい!女が悪い・怖い歌詞4番の真実

木綿のハンカチーフの歌詞が暗示するひどい真実とは 木綿のハンカチーフという歌が持つ歌詞には、ひどい・女が悪い・怖いといったネガティブな側面が隠されています。この記事では、その真実を明らかにし、歌詞の背後にある意味やメッセージを詳しく探求し... -

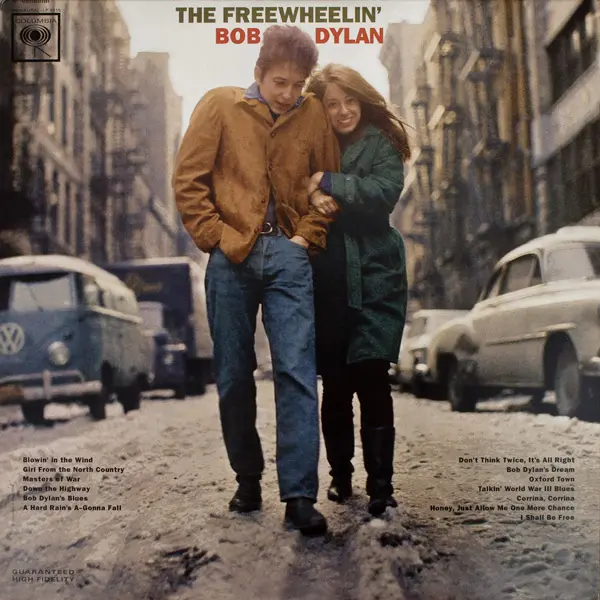

太田裕美の「木綿のハンカチーフ」なぜ木綿?意外ボブディランとの共通点|昭和の名曲

1975年に発売された太田裕美さんの楽曲「木綿のハンカチーフ」は、時代を超えて愛され続けています。 遠距離恋愛の切なさを描いたこの楽曲は、その名前の由来となった"木綿のハンカチーフ"が一体何を象徴するのか、その謎を解き明かすことで、楽曲の奥深さ... -

八神純子のパープルタウンはパクリ?原曲「You Oughta Know By Now」意味や類似点や違いは?

八神純子の代表作パープルタウンはパクリなのか 『パープルタウン』 作詞:三浦徳子 作曲:八神純子、レイ・ケネディ、ジャック・コンラッド、デヴィッド・フォスター 原曲と言われるレイ・ケネディの「You Oughta Know By Now」との類似点や違いは? 八神... -

名曲「白いページの中に」柴田まゆみ 今は?死亡説はホント?

1978年に発売された柴田まゆみさんの「白いページの中に」が なんと42年後、映画『ホテルローヤル』(2020年)主題歌になって話題です。 映画『ホテルローヤル』でこの曲を知ったという方も多いのでは? そして「ヤマハポプコン」で入賞し、デビューシング...

1